Beyond The Billion and the Family Office Alliance came together to host a select group of family offices and investors for an exclusive, invite-only evening at The Billion Dollar Brew in Singapore.

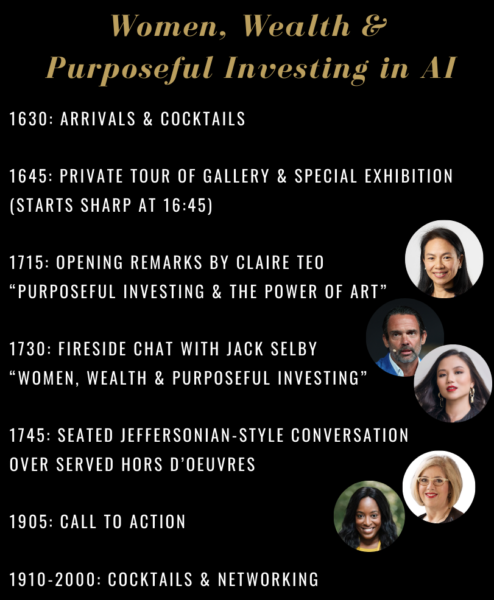

Our event focused on “Women, Wealth & Purposeful Investing in AI”, provided an intimate setting for thought-provoking discussions on how family offices can leverage their wealth toward gender diversity and impactful investments, including in the rapidly evolving AI space.

Set against the backdrop of The Private Museum co-hosted by the Teo family, our guests indulged in an evening of drinks and discovery, exploring how purposeful investing, particularly in women-led ventures, can drive both financial returns and positive societal outcomes.

Family Offices in Asia: Key Trends

Family offices in Asia have been growing at an unprecedented rate, with Singapore emerging as a global hub for ultra-high-net-worth families. In fact, as of 2023, over 1,100 family offices were registered in Singapore, a number that has more than doubled in recent years due to favorable regulations, tax incentives, and the city-state’s stable financial ecosystem.

Across Asia, family offices are increasingly prioritizing impact investing, with a growing focus on sustainability, technology, and diversity-led initiatives.

Women are also playing a more prominent role in the leadership and decision-making within these family structures, driving investment strategies with a long-term, purposeful approach.

The Billion Dollar Brew plays a crucial role in fostering dialogue among investors, family offices, and thought leaders. By creating a platform for open discussion about the intersection of wealth, gender diversity, and emerging technologies such as AI; these gatherings facilitate a deeper understanding of purposeful investment.

Our goals also include forging meaningful connections that drive collaborative efforts, ensuring that family offices are not only generating financial returns but also creating a lasting, positive impact on society.

Highlights of The Evening

Some Key Takeaways:

AI could be an Equalizer in Venture Funding

The rise of artificial intelligence holds immense potential to level the playing field, especially for female founders. AI-driven platforms and tools can help democratize access to capital by reducing bias and streamlining the process, enabling founders to connect with a broader range of investors who might have previously been out of reach. At BTB, we are seeing an increasing number of female founders building in deeptech; and in particular celebrate efforts where spin-out entities enable women who’ve spent years researching and developing a technology are now co-founding commercial teams to build for scale. General Inception built by our Global Advisory Council Member, Paul Conley for example focuses on partnering with scientific teams at the formation level.

Next-Generation Family Offices Embrace Hybrid Strategies

With the increasing prominence of AI and big data, family offices are evolving their investment strategies. Many next-gen family offices are now blending traditional VC exposure with quant-based hedge fund approaches, using data-driven insights to optimize their portfolios and capture value across multiple asset classes. This hybrid model reflects a more sophisticated and nuanced approach to wealth management in the digital age.

Investors continue to be excited about increasing their investment in women-led ventures and acknowledge the need to expand their sourcing strategy which is often more exclusively through existing networks.

Diversification into Global Markets

Asian family offices are diversifying their investments internationally to mitigate risks and tap into growth markets. This trend reflects a broader desire to protect wealth across geographies while maintaining a base in Asia. Family offices are interested in private equity and venture capital as asset classes, but there is still some level of caution where elder generations prioritize capital preservation, and aligning their investments with family-owned businesses or sectors where they can leverage existing expertise.

Philanthropy as Part of Legacy

Philanthropy is becoming a significant focus for family offices in Asia, often seen as a way to build a long-lasting legacy. Many families are setting up foundations or adopting structured approaches to charitable giving. This is seen as a reflection of their values and a way to ensure that their wealth positively impacts future generations and broader society. Our attendees saw that in action with Claire Teo and her family leveraging the power of art and community in The Private Museum; inspired by Claire’s mother’s roots as a dancer.

Professionalization of Family Offices

There’s a growing trend toward the professionalization of family office operations in Asia. With wealth growing rapidly, families are bringing in external talent and adopting institutional-grade practices. This shift helps in balancing family dynamics with business objectives, ensuring the long-term sustainability of the family’s wealth and influence.

However it was noted that the representation of women in family offices is still lacking; and there needs to be a more concerted effort among families to encourage the recruitment, retention, and growth of great women in finance (that are out there!) to lead the charge.

Actionable questions and frameworks for investors:

While an investment thesis dictates where investments are directed, the process dictates how they are executed.

Investment processes rely on assumptions about which expertise is trusted and which practices are considered legitimate within the norms of the investment ecosystem. Some questions BTB has found helpful to investors in making a more concerted effort to remove bias from the investment process:

- How can you use your influence in the market to show others what should be valued?Who or what do people need to see or trust to change their perspective?

- Who could you team up with to promote new values in the market that challenge current views?

- Where are the key decision points, both formal and informal, in the investment process?

- What factors determine whether opportunities are accepted or rejected?

- Where might bias play a role in these decisions?

For more in-depth case studies, we invite you to dive into Our First Billion Global Impact Report.

We at Beyond The Billion extend our deepest gratitude to all the participating family offices and investors at The Billion Dollar Brew (Singapore Edition); for sharing their invaluable insights. Most importantly, we hope that initiatives like ours, which bring the community together to collaborate on solutions, will help fuel women-led innovation globally.

And, of course, a special thank you to our partner, Family Office Alliance and our host, The Private Museum led by Claire Teo, for making this meaningful event possible.

Drive Returns Through Diversity with Us #investinwomen

Take the Pledge: [email protected]

Partner with Us: [email protected]

Invest with Us: [email protected]

Some moments from the event:

About The Organizers

BTB is the world’s first and largest consortium of venture funds pledged to invest over $1Bn into women-founded companies. Beyond the Billion’s (BTB) first pledge campaign was launched as The Billion Dollar Fund for Women in October 2018 with an audacious goal of catalyzing $1 billion into the hands of women founders globally, addressing the gender venture investment gap where women were receiving only 2.2% of all venture capital funding. In under 2 years, $638 million of the first billion pledged was deployed by our partner funds into close to 800 women-founded companies, of which 11 have been recognized as unicorns— from Canva to EverlyWell. To continue to build on this momentum, we launched Beyond The Billion, to catalyze capital deployed to and with these venture funds, ensuring their continued capacity to invest by bridging LPs and GPs, building a community of institutional investors, sovereign funds, IFIs, DFIs, family offices, wealth managers and high net worth individuals; driving the agenda collectively.

The Family Office Alliance is established by Principals of Family Offices in Europe and Asia. We believe that with resilience and common purpose, global challenges can be transformed into uncommon opportunities. Participation in FOA events are strictly by invitation only.