The Billion Dollar Bytes brought to you by Beyond The Billion, powered by Mastercard, is a virtual series focused on fueling women-led innovation.

FinTech is changing not only the way we consume, but also impacting how we save, invest, and transfer funds. On a broader scale, FinTech may shift the balance of power by democratizing financial services, offering greater access to the 31 percent of adults across the globe who don’t yet have accounts with financial institutions.

Today, banking is no longer relegated to face-to-face interaction with “the teller.” You can borrow from peers—or, a stranger across the world—using an app. And, while you may choose to invest with local consultants, they, in turn, may bank entirely on AI to increase the value of your portfolio. Perhaps the most significant impact lies just around the corner: the effects of decentralization. The world’s “unbanked” may soon have access to financial institutions—both new and old—in a way that’s never before been seen. As incumbent financial services players have realized FinTech is not a threat but rather a strategic partnership opportunity, and digital players seek to control more of the customer journey, venture funding of FinTech companies is continuing to set records. What does the future hold for FinTech and financial services? How are women shaping this equation?

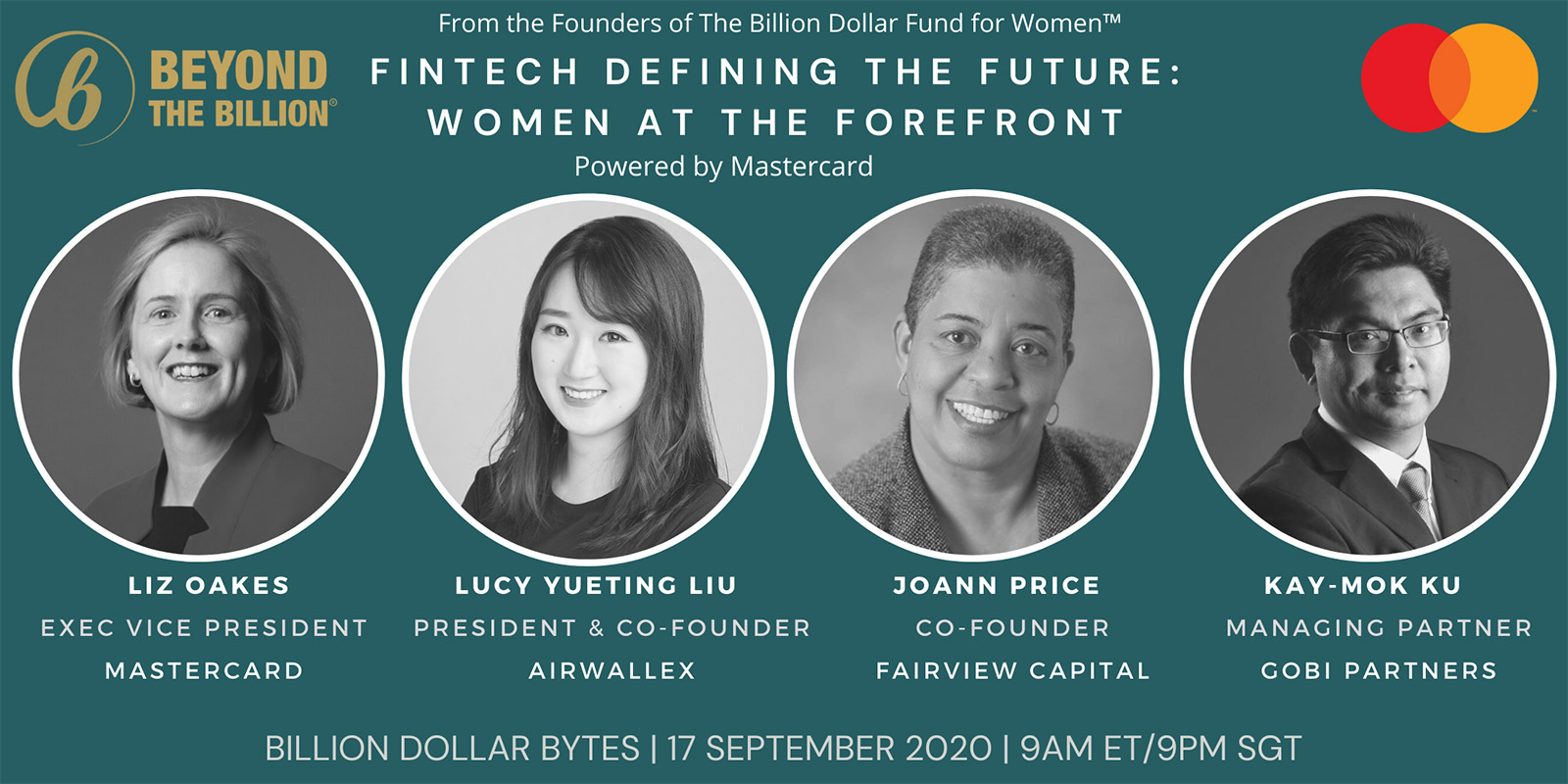

Speakers:

Lucy Yueting Liu, Co-Founder & President, Airwallex

Lucy Liu is Co-founder and President of Airwallex. She is responsible for the company’s branding and operations. Before establishing Airwallex in 2015, Lucy was an investment consultant in CICC (China International Capital Corporation) and served as a board director of Hong Stone Investment Development Limited, a Hong Kong based investment company.

Lucy has won a series of awards for her outstanding entrepreneurial achievements including Ernst & Young “Top 22 Entrepreneurial Winning Women in APAC” (2020), SmartCompany “30 Under 30” (2019), Fintech Australia Female Leader of the Year (2018) and Forbes “30 Young Entrepreneurs in Asia” (2017).

Liz Oakes, Executive Vice President, Strategy & Operations Excellence for Product & Innovation at Mastercard

In this role Liz is responsible for developing Mastercard’s long-term strategy for Products & Innovation to deliver the best, secure end-user and customer experience around the world through co-innovation with clients, partnerships and M&A. Liz also oversees Mastercard’s efforts to deliver integrated services and curated product solutions, enterprise risk management, product management excellence, integrated data analytics and cross-border program execution.

Liz has more than 25 years’ experience in designing central clearing and settlement systems and bank payments systems, globally. This includes the governance and functional design of SEPA, Faster Payments and Bacs systems in the UK, and real-time payments systems strategy and design for national payments infrastructure operators in Australia, India, Singapore, Sweden and the USA. Liz has also supported the design and roll out of new payment systems within bank environments and is focused on the customer experience impact of real-time/instant payments, Open Banking and PSD2. Liz joined Mastercard in 2018 from McKinsey & Company, where she was an expert associate partner in its global payments practice. During her tenure, she served financial institutions, payments businesses and investors on strategy, design and implementation of payment systems, regulation including PSD2 and Open Banking, and supported mergers and acquisitions activity.

JoAnn H. Price, Co-Founder, Fairview Capital

Ms. Price is Co-Founder and Managing Partner of Fairview Capital Partners, an independent, private equity investment management firm, with aggregate fund capitalization of $9.6Bn since inception. Prior to co-founding Fairview, Ms. Price served as president of the National Association of Investment Companies headquartered in Washington, D.C. Ms. Price serves on a number of national advisory committees and private equity advisory boards. Ms. Price is on the board of the Apollo Theater Foundation in New York City. Ms. Price is a graduate of Howard University.

Kay-Mok Ku, Managing Partner, Gobi Partners

Ku Kay-Mok is a partner of Gobi Partners, a leading venture capital firm in Asia with over $1.1Bn assets under management. He has 17 years of business, product development and public administration experience in the technology, media & telecom (TMT) industry, including being co-founder of a Silicon Valley startup. Before joining Gobi, Mok was Vice President of Business Development with Xinya Media, a Gobi portfolio company and operator of branded, pan-Asian Mandarin channels.

—

Dial-in details will be sent upon completion of registration – p.s. don’t forget to update your Zoom!

ABOUT MASTERCARD

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

ABOUT BEYOND THE BILLION™

Beyond The Billion™(BTB), from the Founders of The Billion Dollar Fund for Women™ was founded to address the gender venture investment gap where women-founded teams receive less than 3% of total VC funding. In less than a year, BTB mobilized a global consortium of over 80 venture funds committed to investing $1Bn in women-founded companies. BTB’s mission is now to catalyze the larger landscape of capital, ensuring the continued capacity to invest in women-founded companies by bridging venture funds and limited partner investors. These include institutional investors such as endowments, foundations, international financial institutions, and development financial institutions; as well as strategic corporates, family offices, wealth managers, and high net worth individuals to drive the agenda and capital, collectively.

Missed our last Byte? Catch our recap piece on gender, race and inequality: A Time of Reckoning: Can Venture Capital Heal Itself?